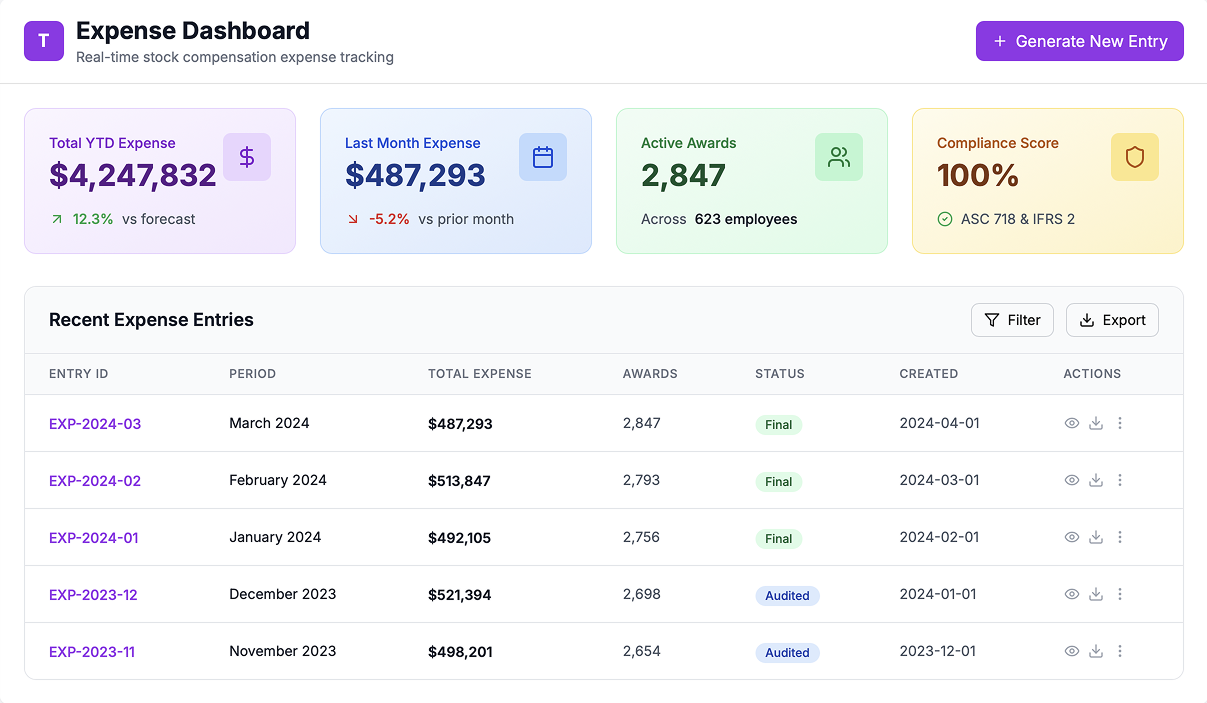

Automate and Audit-Proof Stock-Based Compensation

Enterprise-grade automation for ASC 718 & IFRS 2 compliance. Generate accurate expense entries, create comprehensive disclosure statements, and ensure audit readiness with complete documentation.

Instant

expense entry generation

100%

audit-ready documentation

Complete

disclosure statement automation

Zero

implementation effort

The Audit Readiness Challenge

Manual expense tracking taking weeks or months

Complex compliance requirements for ASC 718 & IFRS 2

Difficult auditor inquiries and lengthy response times

Time-consuming disclosure statement preparation

Multi-jurisdiction compliance complexities

Meet Tranches: Your Complete Solution

Purpose-built for late-stage private companies with complex equity structures, Tranches automates every aspect of stock-based compensation expense management, ensuring you're always audit-ready.

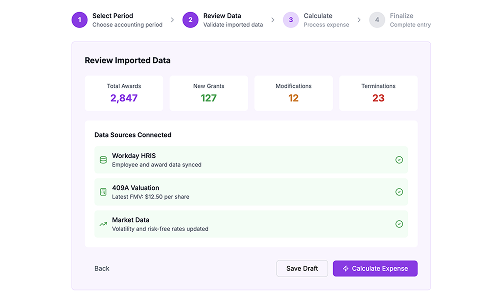

Instant Expense Entries

Automated calculation and generation of precise expense entries

Audit-Ready Results

Built-in compliance for ASC 718 & IFRS 2 with complete documentation

Streamlined Audits

Quick responses to auditor questions with full traceability

Zero Implementation Effort

Seamless setup with automated data migration and instant deployment

Everything You Need for Audit Success

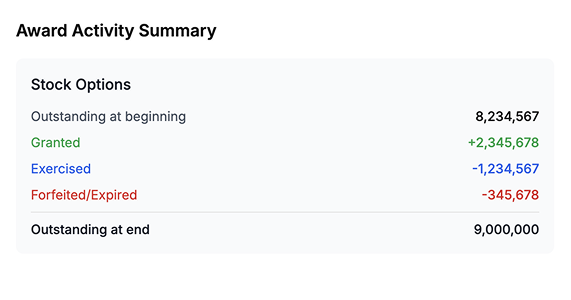

Comprehensive Expense and Disclosure Management

- Automated ASC 718 & IFRS 2 calculations

- Instant expense entry generation for all award types (Options, RSUs, RSAs)

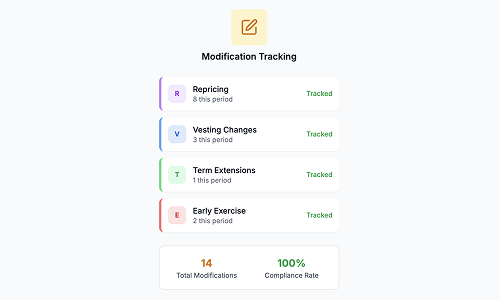

- Complex modification scenario handling

- Accounting period hard close support

- Comprehensive prior period adjustment reporting

- Performance-based award calculations

- Multi-jurisdiction tax accounting

Audit-Ready Documentation

- Complete calculation traceability for auditor reviews

- Comprehensive audit trails and supporting documentation

- Accounting period hard close support

- Comprehensive prior period adjustment reporting

- Automated disclosure statement generation

- Export controls and documentation packages

- Real-time validation and error checking

Complex Scenario Handling

- Modification accounting support

- Rehire and termination processing

- Accelerated vesting calculations

- Multiple modification support

- Early exercise processing

- Liquidity event preparation

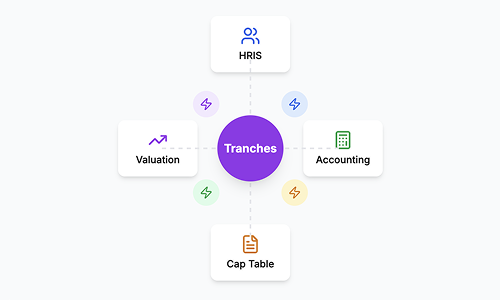

Integration & Automation

- Automated Cap table system integration

- Seamless HRIS and Payroll integration

- Accounting system connectivity

- Custom API endpoints for custom integrations

Security & Compliance

- Role-based access control

- Comprehensive audit trails

- Data encryption

- Compliance monitoring

- Export controls

Be Prepared for Any Audit

Instant Responses

Answer auditor questions immediately with complete documentation

100% Accuracy

Eliminate manual calculation errors with automated precision

Audit Confidence

Walk into audits with complete, organized documentation

Real-Time Updates

Instant recalculations for any changes throughout the year

Streamlined Process

Turn weeks of audit prep into minutes of review

Future-Proof

Ready for IPO or acquisition scenarios with enterprise-grade compliance

Built for Growing Companies Like Yours

Companies from first audit to pre-IPO

Companies with international subsidiaries

Organizations with complex equity structures

Businesses preparing for liquidity events

Companies requiring robust audit compliance

Frequently Asked Questions

Ready to Streamline Your Stock Compensation Audits?

Join leading companies who've achieved audit efficiency and compliance confidence with Tranches.